We all have a story to tell. Our frugal journeys happened at various times and for various reasons. We all did things differently. There is no perfect way or time to start. I know mine started early - then went off track - then got back in line.

I learned to cook, sew, garden, can, mend, launder, and work hard to have what I wanted early on as a child. We all worked around the house doing things. We knew not to waste. Whenever there was something special that I 'WANTED' - I worked and saved for it. I wanted contacts as a teen and my parents said there was no way they were buying them for me. I saved and bought them myself! I bought my first car. I bought some 'special' clothes that I wanted. I learned a good work ethic early.

I got married and got off track there. My ex's family spent money like crazy and it became a bad habit - leaving us full of debt (and no happier). After leaving that situation - I started getting back in the right frame of mind. Luckily, I found a partner in life that agreed me. We both worked very hard to pay off any and all debt, to save and to prepare for the future.

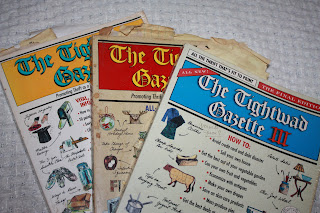

I learned new things and new ways from others as well. I would say my first BIG boost came from the newsletters of The Tightwad Gazette. I saw Amy on TV and ordered her newsletters and then ended up with her books. I would read them front to back over and over.

I know today many of the things are out of date - but the basic ideas are still fantastic. I got all 3 books at yard sales for next to nothing - then I found the complete book years later at a sale. (I do believe the complete has a few things the others don't). I still have all those newsletters too!!!

She truly motivated me to get creative.

Notice all the post-it notes sticking out. These are well marked up and worn from years of use.These books gave me lots of ideas. This is when I started watering just about EVERYTHING down. It is where I got my Rice A Roni recipe and my cream of soup recipe. So many tricks and tips and ideas.I still go through these books every year at some point, just to get myself motivated again.

I have read others and there are a ton of books out there. I used to consume everything I could find (cheaply) on living the frugal life. When I started working hard on this journey - there was no computer and internet at my house. When I did get a computer - it was dial up internet!!!! So needless to say, the world didn't have as much info available as it does today. I READ!!!!

Now I don't do everything they say - as some of the suggestions are pretty far out there! I don't necessarily believe everything I read. I take what works for me and leave the rest. No one person has all the answers.

That is why I do not follow many You Tubers. They are just plain old folks like you and I who are offering up ideas. They have no "insider" info - they are just offering opinions - and we all know what they say about those!!!! Some (many) of the ideas are based on fear and panic. That is NO way to learn anything.

If you are still on the plan to learn (as we should all be) then read good quality info that is not inspired by fear and drama. Follow and read those who are level headed and calm. Nothing can be achieved over night. It truly is a life process.

We should all continue to learn. Each day we should learn something! Take in the info that is good for you and your family and use it. You can adjust it to fit your family. NO ONE has all the answers and NO ONE knows everything. You need to grab bits and pieces here and there.

Tell us how your journey started. Was it a goal? Was it getting out of debt? Was it a necessity?

I love hearing how people got started on the frugal journey and who/what motivated you.

I think we all learn from each other on here - so lets make today another learning opportunity!

Look forward to hearing from you all.

Be blessed!!!!!

I'm frugal, not cheap, and it came from necessity. I've joked that we were the original organic farmers growing up - if we didn't grow it, pick it or kill it, we didn't eat. Yet my sister spends money like she has it. Another driving force was my mom saying that's something I could do when I had my own money. I love the independence that having a nest egg affords me; not just freedom to do what I want but also freedom from worry and the desire to keep up with the Joneses. I also dislike waste. My son has a saying - go to work to make money to buy s&*t you don't need. I don't want my life to be cluttered with stuff I don't need, literally & figuratively. I know that "need" is subjective.

ReplyDeleteBig difference between frugal and cheap for sure!!!!!

DeleteI love it - you grew up knowing what 'real' life was. That is what people did back in the day - it was a way of life. Now everyone is amazed how they may not exist overnight without power!

I like being free from worry as well. There is so much to be said about that feeling. Just a calm in many ways.

You got it right!

I loved reading this, Cheryl. I am not nearly as frugal as I should be and know I waste things sometimes. I do try to buy good quality though that lasts. I was more frugal when our kids were small and most of their clothes were 2nd hand-me-downs or thrifted.

ReplyDeleteI am so proud of you for living what you write about. xo Diana

Thanks. I think we may all get to that point where we tend to 'loosen' up a bit. That is what it is about - really! Like Mona said above - that freedom it gives us now.

DeleteYou did what you needed when you needed to. Now you can enjoy more.

I couldn't write about anything I didn't know or live. I just like sharing, so others may maybe not a mistake or take a path that can hurt them.

Thank you!

What an interesting question, Cheryl! I'll look forward to reading all of the replies. And yes, I about wore out my Tightwad Gazette books back in the day.

ReplyDeleteFor me, what my grandparents (who started their family during the Depression years) called "thriftiness" has been an ongoing journey through my 60 years of life. Kind of like life itself, I suppose. Tightening up and being more mindful during lean times. Easing up during other times. One thread that's always been there, though, running through my life, is the firm message they taught: waste nothing. To them, waste was a sin. They repurposed/recycled before those terms were ever used. Hole-y socks were darned. Stretched out elastic was replaced. Food scraps became pots of soup. And I guess that's always been there in my mind. Along with buying quality items that last for years at the best prices possible. Not necessarily brand new. --Elise

I do believe for many of us it has been a journey. That is what it should be. Learning and fine tuning along the way.

DeleteWaste not - want not - installed here as well. There was always another use. I still try to do that - not so much because of money, but because it just makes good sense and takes care of the environment.

I love this. It will be fun seeing all the responses.

I think there are so many on the same pathway and have just gotten there in a different way.

I think my frugalness is genetic. My ancestors were never very wealthy. One branch was Catholic in Northern Ireland when that meant persecution, no land ownership, menial labor, and deadly poverty (and my 3-gr-grandfather still lived to be 102!) When my gr-gr-grandmother was widowed with 8 kids, she and her sister-in-law came to America so her children would have a future.

ReplyDeleteWhen my maternal grandparents started out married life and my mother was born in 1937 they lived in a two-room shack with a dirt floor on a doctor's horse farm in N.Central Kansas. Grandad worked during the day (had a job through the WPA), and Grandma was there to keep people from stealing the doctor's horses. Although they became comfortably middle class in their later years, there was never much money. Their four children all went to at least two years of college.

My paternal grandparents were dirt poor all their lives. My grandpa lost the farm (in SE Kansas) during the Depression (and never trusted banks after that). They rented various places in town and small farms. Having three kids already when Grandma became pregnant with my father and his twin sister in 1936, my grandpa went into a deep depression. My grandma ordered him out of bed and to find some work. He ended up working for the Civilian Conservation Corps heading a work crew of men who taught other farmers how and where to build sanitary outhouses. Grandma ran the chicken farm and sold produce on the roadside. She worked in a local garment plant sewing military uniforms during WWII. They got electricity in the late 1950s when the Rural Electric Cooperative came through and strung lines. The first thing my grandma bought was an electric Singer sewing machine. They never had indoor plumbing on that last farm, but had a cistern with a pump for the house and a well near the milking barn (by then they only had about a dozen milk cows and sold the milk for cheese). All five of their surviving children attended at least two years of college, with the three boys becoming an engineer, a lawyer, and an engineering law specialist.

Growing up, we lived well beneath our means. My father, who often had not had even the necessities of life, felt that giving a child any more than a roof over their head, basic food, and basic clothing was spoiling them. My mother was not quite so strict. By the time I was 14, my mother went to work part-time, and I became the homemaker and watched my younger sister. (My brother didn't have to do anything that was "women's work" according to my father.) So I learned how to cook, sew, and already lived frugally. I worked part-time and saved enough to buy a used car because my father would not allow us kids to drive the family car after we graduated from HS. I earned a full academic scholarship to WSU and was in my first semester (and working part-time) when my father threw me out. I was allowed to take nothing I had not purchased myself except my mattress (which he was going to throw out anyway). So I found a roommate and rented a little house in a rundown part of town, got two more part-time jobs (and finally a full-time job) and graduated four years later.

During my first marriage (to a man who would spend every penny and then some), I stayed home and raised two sons on very little money. Handmedowns, garage sales, collecting aluminum cans for pizza money, no new clothes for me. When the first husband left after 17 years and cleaned out the bank account, I had a part-time, minimum wage job and an 8yo and 12yo. That was when my frugality really kicked in to overdrive. Thanks to a deep pantry (and me skipping meals) I lasted 5 mos. before finally having to apply for food stamps (which I was on for another 5 mos. until I got a full time job when school started). First husband swore to my face that he would see me homeless, penniless, and living on a steam grate, and he tried very hard to impoverish me. He initiated the divorce and did everything he could to cause me big legal fees. In the end, 4-1/2 years later, the divorce settlement equaled the amount I had paid in legal fees ($23,000). I was 44 years old and starting over again. Since my frugality skills were by then highly honed, I was able to make it.

DeleteFortunately, my current husband is of the same mindset regarding money that I am. Since I will not get any of his pension, we are carefully husbanding our money so that I will have enough to live on the rest of my life. Yes, we could live a lot higher on the hog than we do, but neither one of us has the desire to do so. That's why it's nice to be able to come here and know that there are other like-minded people out there. I sure don't see it here in the trailer park.

What role models you had. It is awful they went through all that - but they hung tough and made it through - testament as to why you are here! You should write a book about the family - that is all so very interesting. Hard work and perseverance sure does work. Quite a testimony to your stock my lady!

DeleteFrances just read part 2 - wow. How horrible. Isn't it amazing what we can do when we have to? You had children to tend to and rear and you HAD to make it work.

DeleteThis what gets me about people today - no drive to do the right thing. You were willing to go without so your children could survive.

We never know other's stories until moments like this and it really humbling to see what people have gone through and survived. I am so happy you found a mate that gets it. It sure is nice.

You have friends here my friend - we are all of the same mindset. Living good on little!!!!!!!

Thank you so much for sharing.

I was raised by a frugal grandmother and a frittering mother. My mom loved to spend and taught us to spend. She also was on us to save, but we spent. We learned frugal ways from her and her mother, but not how to manage money at all. In fact, my mother had bad credit and encouraged my sister and I to open credit in high school so she could use it. We learned to work almost full-time jobs by the time we were 15 and go to school. We bought and bought everything we wanted and everything mom wanted. I was heavily in debt by the time I graduated from high school. It was crazy, now that I think about it. I was forced to become frugal when I got married and Hubs was out of work for most of the first 10 years. It was a Carter years, and it was very, very hard. I hated it. I still have PTSD from it. Hubs never had a job that could support a family. The state just did not pay enough. In fact you were given a food stamp application with your pay package. The state of Idaho expected you to apply for all federal programs to offset their low pay. I have never been debt free. Never. But I really had to learn to buckle down and become almost debt free. It took years or relearning old skills, which I had and then putting them to use, which I do that is getting us there.

ReplyDeleteWOW - that is amazing. What a different story on learning to be frugal. We all need to hear these stories - you are helping someone right this moment by sharing. I thank you for that.

DeleteI now understand your obsession with saving and your charts and all the little things you do. It makes sense to me now.

We are never too old to learn and change. Life is one big learning curve.

Thanks for sharing.

OUT MY WINDOW _ I'm really surprised about a state job paying so badly. I've said to my husband many times that I should have gotten a government job when I was young as the long term benefits would have been great. We're in Calif. and well into our retirement years and are comfortably off so frugality did it for us. What was your husband's job skill that kept him out work for a decade?

DeleteAnne I kind of wondered that too. State jobs here in IN have always paid pretty decent.

DeleteHE was a Forester with a Master's degree. No, the State of Idaho is flush with money because they make it on the backs of the State employees. So when you see Idaho brag about being solvent when so many states are not remember that. Also Hub's was determined to be a Forester, (he is brilliant, mathematically, and musically) but likely on the spectrum. He could or would do nothing else. One track mind. Forestry jobs were very hard to get back in the 80's. You had to be not white and a woman to get a job. The Forest service was actually paying secretaries to go back to college to get Forestry degrees so they could meet the quota of females that the Government set. A white male would not be hired. No way. He would work 3-4 months a year fighting fire and then the Forest service knew exactly when to lay these men off so they could not collect unemployment. There were no government programs to help if you were married. If I wanted food stamps or assistance, I had to get a divorce. What a dumb rule. This is what caused the abandonment of inner-city kids by their fathers. It lasted for 20 years before the Feds realized they were causing the problem. Stupid. I just worked any job I could went back to school, but really did not know how to manage money. I was just so darn grateful after 12 years of marriage he finally got a fulltime job with benefits, that we could not afford, but I do have to say that the State of Idaho has a great retirement, and they take good care of their retirees. We started out 7 years ago with about 1500.00 a month and now it is $1850.00 so really keeps up with inflation. Add the SSi which is not super high as Hub's only worked full time for 28 years, he didn't get full time work until he was almost 40. We actually made much more money after he retired and did nothing. God is good. He actually works harder now that he is retired I think.

DeleteWOW Kim - that is something. I would never have thought that about forestry. I had a friend that went to Alaska back in the 70's for that and stayed. BUT, yes, a girl!

DeleteYou have sure given me an education today! It is amazing how govt. can say one thing and do another. Of course, I guess that really doesn't surprise anyone today.

Thank you for answering and educating us.

So glad things turned around and turned out well!!!!!

So much from my young years back and forth between my ultra frugal grandparents and my insatiable stepdad. He grew up with nothing and lived to 81 yo trying to buy everything. He and a relative started a business that turned very profitable in the early 80s. Small business started with everyone mortgaging homes for the start up.

ReplyDeleteYikes huh?! Money was plentiful and I went away to college and lived like a princess, in the words of my roommate!! Fast forward to getting married in my early 30s. My husband and I rented my dad's house (parents divorced) because my dad couldn't decide if he wanted to remarry. He was living with his gf. He didn't want to rent to strangers, he gave us a great deal in exchange for upkeep and said it would help us save money for a house. Great. 6 wks. after our wedding was a giant earthquake. Dad's gf's house was red tagged and the house my brother was sharing with friends burned to the ground from a gas leak. Dad and brother both moved in. Imagine the worst lol. My brother was an absolute pain in the butt. He seemed to think he was there as a guest. He cleaned nothing, made messes, ate our groceries, and added NOTHING to the house but, "It's not my house so it's not my problem." Our total irritation turned into motivation to get out ASAP. Finding the Tightwad Gazette in a used bookstore had to be a God-incidence. That led to selling and saving at a phenomenal rate. The housing market in Cali was at a foreclosure peak and we found a small home for 1/3 of it's original price. It was only 2 years old. The 90s were not easy but we tightwadded like crazy . We worked hard so I could quit my job when I got pregnant. Alas, I lost my baby and we had no kids. The housing market went berserk and while everyone was trying to buy bigger and fancier, we got the heck out of California!! Our housing profit made it possible to move without a job and buy a house.

So, as it turned out, my brother's most insufferable behavior motivated us and the timing was ideal!!! The reason I told you about my college days of Spiegel catalog shopping and Godiva chocolate in my fridge was because when my old roommate found out I had become a Tightwad, her response was, "Well, if you can switch from the way you lived in college to a Frugalista, ANYONE CAN!!!! You're proof that it can be done!"

Sorry that was a bit long, but there it is!!

Great story. Sometimes the worse things that happen in life are what tend to be our blessings. This kind of proves it. Had not your dad and brother all moved back in - well you may have gone on spending and not saving.

DeleteI am sorry for the loss of your baby.

Sure we could have all gone bigger and fancier probably - but the end result is debt and no money. Living a good and comfortable life says so much more than a fancy house.

Your girlfriend had a great response!!!

I do believe you have become the frugalista for sure.

Thanks!!!!!

Excellent advice, Cheryl. I do not watch many YouTube channels for that reason also. The editing needed is not there. Reading a book is so much better at least to me anyway.

ReplyDeleteThanks. Yes, reading a book or even a blog post is much different than all the panic and fear mongering the YT channels portray. It is common sense. Nothing in this world hasn't been seen time after time. People survive and move on.

DeleteGive me my copy of TWG and I am cool!

My journey is similar in many ways. I was raised in a small community that was known for fruit and vegetable production. My maternal great-grandparents were peach farmers, and my maternal grandparents maintained a large garden on their property to provide for their family (including mine). My paternal grandparents also worked on farms (meat and dairy), but were farther away and I didn't see them often. My grandmother sewed, knitted, crocheted, and quilted, as well as canned and froze goods for use in the winter. We later found there was some homemade hooch in the cellar as well. LOL!!! My mom was, for the most part, a homemaker and in retrospect we lived a very frugal lifestyle. Vacations were driving to state and national parks, camping, and hiking. Mom cooked our meals and could stretch a pound of ground beef like no other; eating out was an exceptional treat. I learned to cook, bake, and can at my grandmother’s knee. While frugality was ever present, it came along with learning about quality vs. cost -- mending commercially made clothing all the time taught me how much better homemade was; knowing the taste of home canned tomatoes and strawberry jam that rivals the name brand. As a “city girl”, I still put up tomatoes, pickles, jams, fruit, and sauces, simply because I like them better. And I now put up more than I did in the past – quality, flavor, and pride in what I can do.

ReplyDeleteI married a city guy who made a good wage, and I worked as well. We lived well, and his feeling was that he worked hard for what he made and we should be able to get want we wanted. When he suddenly passed away 8 years ago from a heart attack, that debt became real. Additionally, I suddenly found out that there was a significant reduction in his pension payments -- widows pension was 50% of his take, and two smaller pensions "died with him". When you don't know if you'll be able to make the mortgage payment, it becomes real.

I tightened the purse strings on everything that I could and developed a plan for paying off everything as quickly as possible. I also knew that I needed to raise my credit score if I wanted to move out of our 100+ year old house that would require maintenance beyond what I could handle (we’d listed the house for sale the week before hubs passed, so I’d already “disconnected” and was ready to move; I just took a little longer than we originally planned). Three years later I moved into a place that is safer and with less maintenance, refinanced 2 years ago to a 2.25% mortgage and negotiated my own 0% auto loan when my old car was on its last legs.

Because there are other goals that I want to achieve, I'm still taking the frugal path so I can let my investment accounts grow as long as possible before starting to make withdrawals. It's kind of become a game of how little can I spend while still enjoying my life. Making the best of every day ...

First I love hearing about your background. You sound like you had a pretty great childhood and did a lot of the same things I got to do.

DeleteGrammy and grampy had some hoochy stashed huh?? LOL Oh my goodness, that is a hoot.

Loss of a partner sure does change how you think and how you live. No one will understand just how much until they have gone through it. I was fortunate that G set his retirement up to take less while living, so that I would have the same amount forever.

You got a quick lesson in finance 101. So sorry you had to do that, but I guarantee you it has made you a stronger and more capable woman. Again something good always comes from something bad.

I, like you could spend and buy things, but yes, it is kind of game. I like telling myself no - you don't NEED that!! LOL

You keep doing what you are doing - cause you got a grip on it. You will meet those other goals.

Thanks.

Thanks, Cheryl. I share this story as so many women assume that their spouse's pension will continue to be deposited the same as always, when in fact, it can drastically change. And those changes have a direct impact on your way of life. Luckily, I was able to recover and learn to better live within my means (and there WAS a deferred comp account, but it took a long time for the paperwork to get pushed through to move it into my name; I've yet to touch those funds).

DeleteThanks for sharing - it is very useful info that all married women need to know. You are doing great. Be very proud of yourself!

DeleteI didn't grow up with a lot. My dad had a small farm and mom had a large garden. We ate the produce and she canned and froze as much as she could. I remember we grew lots of potatoes and they were stored in the cellar under the stairs. I can still smell the earthy odor thinking back.

ReplyDeleteWhen I started working it was mostly minimum wage jobs, and I had my daughter young. Mom and Dad helped out by babysitting until she was four and I was transferred to the city we currently live in. My son was born here a couple of years later. I managed at that time to purchase my first home. It was a dollhouse - about 800 square feet over three floors. There wasn't a whole lot of money but that dropped even more when I decided to go to university. My student loan was $1250 a month, I paid $600 or so for mortgage and utilities, daycare was $350 and the rest had to cover groceries, kids clothing, gas and insurance for the car. I was allowed to earn up to $200 a month from a part time job but I never made that much - with two kids and university I didn't have the time.

Life got much easier after university and I learned how to spend. When I look back now it makes me a little regretful for what I wasted. But I still managed to put money away in savings and eliminated all debt with the exception of my mortgage. I know I've mentioned this before - this is good debt and bad debt - I made certain to get rid of the bad debt first.

Now that I'm retired and my income is about 50% of what I was making when I worked, I've definitely cut back on spending. The pandemic really helped me see what was really necessary and what wasn't.

When I worked I set aside a separate fund for travel that would allow me to take one trip a year until I'm 85 (or possibly even longer). I'm a frugal traveller and search out the best deals.

Even though I'm spending a fair chunk of change on repairs and improvements in the house, it's meant to allow me to sell by the end of 2023. This will help me reduce costs as well going forward.

It was interesting reading about the journey's other's have taken. Thanks for asking the question.

You did great. Goodness you had a lot on your plate in your young life. You went ofeter it and got it. That is fantastic.

DeleteI think the past couple years has shown a lot of people that less can be more!! Wants and needs are different. There again good coming from bad.

I love that you have yourself planned and setting up for travel until at least 85. That is admorable. The home imoprovements will just help your bottom dollar when you do sell. Sometimes we have to spend a little to make some.

It has been enlightening reading all the stories today.

Thanks!

I was always pretty careful with my money, both by nature and by necessity. I lived within my means and never ran unnecessary debt.

ReplyDeleteBut I discovered Amy D. in Parade Magazine, ordered a couple of her newsletters, and became a slavish convert. I realized I could see how low below my means I could go and sock away the extra. I even got one of my hints printed in her newsletter. I still have them all in a notebook.

She sure changed a lot of lives. It was always a challenge to see how low you could go and love WELL.

DeleteYou were already on the right track and then BOOM.

Love you still have yours as well!

I guess my frugal journey began when I was pregnant with our second child and the factory where Harvey worked shut down laying off all their employees.

ReplyDeleteGod bless.

Oh my goodness, that had to be very scary. Sometimes necessity of the mother of invention. We learn a lot in a situation like that.

DeleteI grew up poor but I never knew it. I never felt like I was any different, we had a home, good food and clothes on our backs. I learned my frugal ways just from living everyday life. My husband grew up the same. His parents were wonderful, they were not able to buy their first home until they were fifty. They put everything into giving their kids the best they could. We bought out first at twenty five. I will say that when we started making money I had to put myself in charge of finances. We had plenty of money but that did not mean we should blow thru it. I still might be considered poor but I have no debt, I don't feel the need to have things just to have them. The house is paid off, no car payment, the son went to a good University and there are no student loans. It is nice not to have to worry about security now.

ReplyDeleteYour last few sentences show you are in no way poor! You did so well over the years. It is easy to spend when things look good - that is what gets a lot of people.

DeleteNo worry and security is priceless.

Being frugal always appealed to me. It just makes sense. Why spend $5 when $2 will get you the same?

ReplyDeleteWhen I finally was earning my own money I could buy my own clothes that I liked. Believe me I dressed well and inexpensively. I would look through every sale/clearance rack at the mall. It'd take me 2-3 hours. (And I don't like clothes shopping.) I'd come home with $5 & $10 items. I'd spend $25 maybe even up to $50 and then I'd add up the original prices which sometimes was $200 or more! That sure drove home the value of shopping carefully! And then I wouldn't go shopping again for a long time. There were people who would say to me you don't know what it's like to be poor (because I never looked it). It did bother me that they assumed I was "rich" because I dressed nicely and therefore must not have any worries. There were times I had $0 and 0 cents in my wallet. I cared about my appearance and used my money carefully on quality items. (I was working and going to school paying for it myself.)

Later to be a stay at home mom I saw my contribution was to use what my husband earned wisely. He's not as careful as I am but most of the time he's not recklessly spending either. He appreciates what I do. The easiest way to save money was to do it myself--cook, sew, use the library, shop the church rummage sale, stock up on sales.

I love The Tightwad Gazette! So inspirational. I have to admit I haven't used most of the ideas but I read it every so often just to be inspired. It's a way of thinking.

Two books I bought at our church's rummage sale years ago are Make Your Own Groceries and More Make Your Own Groceries. Love these books. I use them all the time!

I'm always borrowing books from the library or through interlibrary loan on doing stuff on your own. I love learning new things or about things others do even if I know it won't ever apply to me.

My mother was thrifty but not in a joyful way and she didn't really share or teach us about it. We knew she shopped sales and that we had no money. She didn't can or put up food though she grew up on a farm. She sewed a little but not much. She'd rather shop a sale at Sears or go to a garage sale. Her thriftiness was from careful grocery shopping, camping vacations, rarely eating out and telling us NO! lol

What I learned I learned on my own or by reading. This spring I'm starting seedlings. I've never tried that before. Mom doesn't get it. She said you can get 6 tomato plants for $1.98 at the garden shop why worry over seedlings? I said well I got a packet of seeds for less than that. She didn't have an answer for that! Besides the cost savings I want to see if I can do it! I don't know why but it always seemed hard to me (probably because my first couple of gardens didn't do too well until I understood vegetable gardening better). There seems to be a power in knowing I can start my own seeds and not depend on getting plants from someone else! Next learning will be seed saving! So much more fun than watching tv! hahahaha

As a side note we were talking about using stuff past the expiration date here recently.. A couple days later I bought 8 bottles of Kraft BBQ sauce for 49 cents each and 6 bottles of Olice garden salad dressing for 49 cents each. They expire this month. I expect to use them all by the end of the year but if not I read they will last at least 2 years past the expiration date. That has been my experience in the past.

Your first paragraph speaks volumes. Why spend $5 when $2 will do! Love it.

DeleteI sew a lot as a teen and made many clothes and bought as well. I was known for having so many clothes - but did it on a shoestring for sure.

Knowledge is power!!!!!! It always wonderful to learn new skills and ideas. We should all be like a sponge and absorb each day.

You are so right about your BBQ sauce and dressing - they will last way, way past that best if used by date. Anything that contains vinegar really lasts for ages.

Enjoy them. Keep on learning!!!

What a great topic! My stepdad grew up very poor and never wanted to be like that again. He had the best work ethic that he passed down to us kids. We grew up well taken care of but did frugal things. My mom sewed almost all of our and her clothes, cooked at home, we went camping instead of staying at hotels for vacations, and didn't go out to eat. It was a way of life but my parents never talked to us about managing money.

ReplyDeleteMy husband's family were hard workers but spendthrifts and my husband was raised to spend what you earned, which spilled over into our marriage. I was a stay at home mom when our girls were small and that is when I found The Tightwad Gazette which changed so many things. One of the most frugal skills I have is learning how to sew using fabric, tablecloths, curtains, or whatever I can find at thrift stores or on deep clearance at the store. I also followed blogs like this one that gave me a sense of community in frugal living.

When our girls were older we started our own business and we taught them how to make and manage their own money. We also home schooled them until they graduated high school, so we were spending lots of time together as a family. We finally were making enough money to live comfortably but still weren't putting much of it away. Fast track to the last 10 years and my husband and I are living on far less than we make. We have no debt except our small mortgage. I work full time and he is semi-retired. We have really simplified our lives financially.

What a great story. Amazing how many people found Amy and TWG. She made it a challenge to spend less. Many great ideas. It really does become a lifestyle.

DeleteYou did well. Sounds like you gave great examples to your children in so many ways.

Many people think living simply means living poor. It does not - it means SMART in my opinion.

We are a community!!!!!

Fun blog. Inspired me to pull out the tightwad.

ReplyDelete